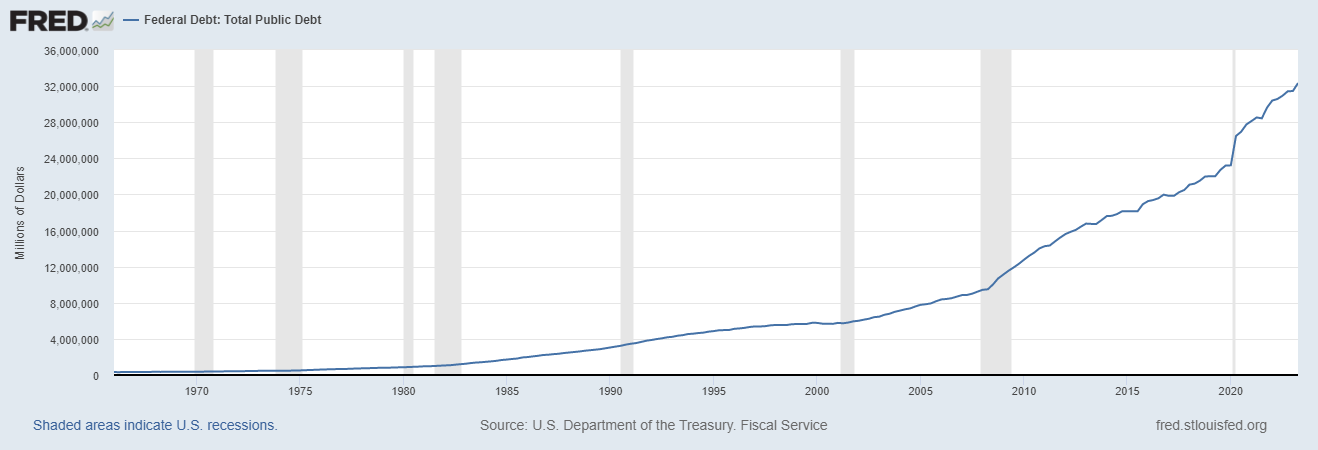

In the vast and intricate realm of economic policy, the trajectory of the U.S. federal debt has become a topic of increasing concern. As the nation’s debt and deficits continue to swell at the current rate, there are storm clouds on the economic horizon that warrant our attention. In this exploration, we will unravel the potential consequences of persistently high levels of debt, the specter of inflation reminiscent of the 1970s, and the intricate dance between the Federal Reserve and the risks of fiscal dominance and a prolonged bear market in bonds.

The Growing Debt Dilemma:

The U.S. federal debt, a metric that reflects the cumulative borrowing of the federal government, has reached unprecedented levels. As deficits persist and the debt expands, questions arise about the sustainability of such a trajectory. If the current trend persists, a future where the debt continues to mount could have profound implications for the economic well-being of the nation.

Inflation’s Ghost: A Return to the 1970s?

The haunting specter of inflation, reminiscent of the turbulent 1970s, adds an additional layer of complexity to the U.S. economic landscape. If inflation were to make a comeback, the Federal Reserve would likely be compelled to take measures to curb it. One such measure involves raising the federal funds rate, a move aimed at making borrowing more expensive and cooling off inflationary pressures.

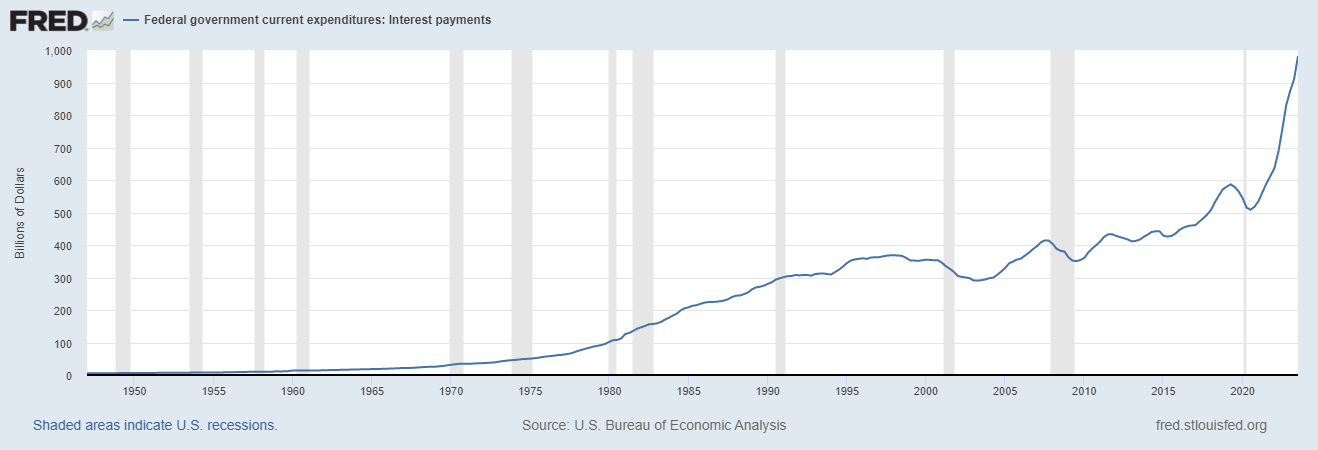

However, this strategy comes with its own set of challenges. A hike in the federal funds rate would lead to an increase in interest rates across the board. As a consequence, the interest expense on the federal debt would surge, compounding the fiscal burden. This creates a delicate balancing act for the Federal Reserve, as its efforts to combat inflation may inadvertently exacerbate the financial strain caused by the growing debt.

A looming risk in this economic scenario is the potential for fiscal dominance. This phenomenon occurs when fiscal policy, primarily controlled by the government, exerts undue influence over monetary policy. In the context of the U.S. federal debt, the risk emerges if the government prioritizes debt reduction over other economic objectives.

Fiscal dominance places the Federal Reserve in a precarious position, potentially compromising its independence in setting monetary policy. The interplay between fiscal and monetary policies becomes a delicate tug of war, with the risk of the government’s debt reduction goals overshadowing broader economic stability considerations.

The risk of fiscal dominance is not a theoretical abstraction but a tangible challenge with historical precedents. In times of economic turmoil, governments are often compelled to adopt expansionary fiscal policies to stimulate growth and mitigate the impact of recessions. While this approach can be effective in the short term, it raises concerns about the long-term sustainability of such policies, particularly when they result in a ballooning federal debt.

Monetizing debt, or the practice of central banks directly financing government spending by purchasing government securities, is a potential avenue that blurs the lines between fiscal and monetary policies. While this approach may offer a short-term reprieve by providing the government with access to low-cost financing, it poses inherent risks to the stability of the monetary system.

One of the primary dangers of debt monetization is the potential for hyperinflation. As the money supply expands rapidly without a corresponding increase in goods and services, the purchasing power of the currency erodes, leading to a vicious cycle of rising prices. This historical specter, epitomized by episodes like the Weimar Republic in the early 20th century, serves as a stark warning against the unbridled monetization of debt.

The Bear Market in Bonds: A Prolonged Struggle:

Another concern on the economic horizon is the risk of a long bear market in bonds. Traditionally, bonds have been a stalwart of investment portfolios, providing stability and income. However, if the market sentiment turns against bonds, leading to a prolonged bear market, the consequences could be far-reaching.

In a bear market for bonds, interest rates rise, and bond prices fall. Given the substantial role that bonds play in financing government debt, a prolonged bear market would translate into higher borrowing costs for the government. This could amplify the challenges posed by the already ballooning interest expense, further exacerbating the fiscal strain.

A long-term bear market in bonds could have far-reaching consequences for the U.S. economy:

Cost of Borrowing:

As interest rates rise, the cost of borrowing for businesses and individuals would increase. This could potentially dampen investment and consumer spending, leading to a slowdown in economic activity.

Government Finances:

Higher interest rates would escalate the cost of servicing the U.S. government’s substantial debt. This could necessitate a reevaluation of fiscal policies and potentially impact the government’s ability to fund essential programs without cutting spending or raising taxes.

Asset Valuations:

The inverse relationship between bond prices and interest rates implies that other assets, such as equities and real estate, could face headwinds. Investors may reassess their portfolios in response to the changing risk-return dynamics.

The ramifications of a long-term bear market in bonds would extend beyond U.S. borders:

Global Financial Markets:

Bond markets are interconnected globally. A sustained rise in U.S. interest rates could trigger adjustments in global portfolios, affecting bond markets in other major economies. Emerging markets, in particular, could face challenges as investors seek higher yields in a rising rate environment.

Exchange Rates:

Higher U.S. interest rates may attract capital inflows, strengthening the U.S. dollar. This could have implications for exchange rates, potentially impacting the competitiveness of other currencies and affecting international trade dynamics.

Commodity Prices:

Changes in interest rates can influence commodity prices. A stronger dollar, coupled with potential shifts in demand patterns, could impact the prices of commodities such as oil and metals, affecting economies heavily dependent on commodity exports.

Implications for Other Asset Classes:

A long-term bear market in bonds would reshape the landscape for various asset classes:

Equities:

Historically, there has been an inverse relationship between bond and equity prices. If bond yields rise, equities may face headwinds as investors reassess the risk-return profile. Sectors that traditionally benefit from low-interest rates, such as technology and growth stocks, could be particularly sensitive.

Real Estate:

Higher interest rates often translate into higher mortgage rates, affecting the affordability of real estate. This could impact property prices and the demand for residential and commercial real estate.

Gold and Precious Metals:

Precious metals, particularly gold, are often seen as hedges against inflation and uncertainty. A bear market in bonds, driven by inflationary concerns, could enhance the appeal of gold as a store of value.

Financial Repression: A Controversial Lifeline?

Amidst these challenges, the concept of financial repression emerges as a controversial lifeline. This strategy involves deliberately keeping interest rates below the rate of inflation, allowing inflation to erode the real value of debt over time. While proponents argue that this approach can facilitate a subtle reduction in the debt burden, it is not without its ethical and economic complexities.

Financial repression functions as a double-edged sword. On one hand, it offers a potential avenue to mitigate the real value of the debt and decrease the burden on government finances. On the other hand, it imposes an implicit tax on savers, eroding the purchasing power of households and investors who rely on fixed-income investments for income.

Conclusion:

The sustainability of the U.S. federal debt is a multifaceted challenge that requires careful consideration and proactive policy responses. If the current trajectory of debt and deficits continues unabated, the consequences could be far-reaching, with implications for government spending, economic stability, and the financial well-being of citizens.

As we navigate these economic waters, it is imperative to weigh the risks of inflation, fiscal dominance, and a potential bear market in bonds. The delicate dance between the Federal Reserve and fiscal policies demands a nuanced approach that prioritizes both short-term economic stability and long-term fiscal health.

Financial repression, while controversial, remains a potential tool in the policy toolkit. However, its implementation requires a careful balance between reducing the debt burden and safeguarding the interests of savers and investors.

In charting the course forward, policymakers must engage in informed and transparent discussions, recognizing the trade-offs inherent in various strategies. The road ahead demands a careful navigation of economic waters, with an unwavering commitment to the well-being and prosperity of the nation.